Subscribe to Bankless or sign in

1️⃣ SEC kicks ETH ETF can

Gary Gensler is on a mission to waste as much of his time as possible.

The SEC is holding off decisions on  Ethereum ETFs from Grayscale and BlackRock until March, with further delays expected, possibly until May. This decision may be reflected in Ethereum’s price this week, dropping 9%. While

Ethereum ETFs from Grayscale and BlackRock until March, with further delays expected, possibly until May. This decision may be reflected in Ethereum’s price this week, dropping 9%. While ![]() Bitcoin also slipped to a two-month low of $38,500, it’s rallied back to around the $42k mark.

Bitcoin also slipped to a two-month low of $38,500, it’s rallied back to around the $42k mark.

The SEC, cautious after narrowly approving Bitcoin ETFs, is now evaluating Ethereum's Proof of Stake and centralization concerns — allegedly concerned about Ethereum’s potential for manipulation.

Most analysts weren't expecting to see approval come until May at the earliest because SEC incompetency is already so priced-in. And while the SEC has shown itself hilariously inadequate at actually stopping the adoption of crypto, they're likely going to try to fight this any way they can.

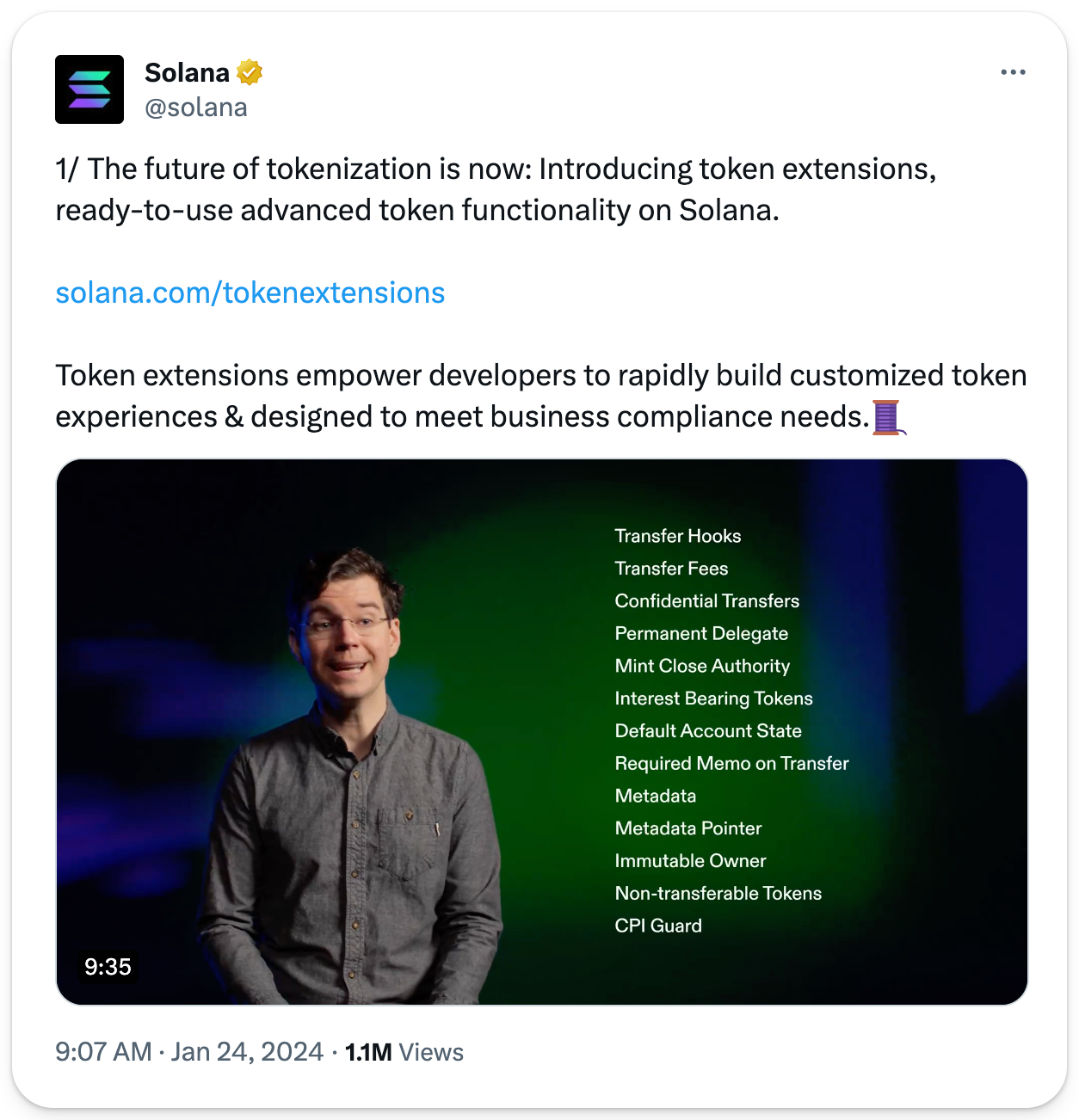

2️⃣  Solana token shake-up

Solana token shake-up

The Solana Foundation upgraded its SPL token standard — Solana’s version of ERC20s — with new token extensions, offering features like confidential transfers and token swap fees.

This isn’t just techy stuff; it’s a big win for businesses looking to do more on blockchains. Solana’s token extensions let companies customize tokens to match their security and compliance preferences. This appeals to companies like  Paxos and GMO-Z Trust Company, who both issue stablecoins and have already adopted these extensions.

Paxos and GMO-Z Trust Company, who both issue stablecoins and have already adopted these extensions.

3️⃣ CoW Swap fee switch

Following a vote by CoW DAO, the decision is in — the fee switch is officially activated.

Jan 23 kicked off their 6-month experiment on new fee models for the CoW Protocol. Fee switches are a big deal in crypto, with many protocols hesitant to turn them on. Less disruptive models will be tested first, like collecting fees from market orders. The moo-lah will be used to boost development, increase users, and enhance token utility.

4️⃣ Terra bankruptcy

Terraform Labs, creator of TerraUSD/LUNA, filed for Chapter 11 bankruptcy early this week. Filing for bankruptcy is their strategy to stay afloat as they maneuver through choppy waters. After the 2022 collapse of its tokens, TFL faces legal challenges in Singapore and the U.S. Do Kwon, the former CEO, is also currently detained in Montenegro for his own trials before extradition to the U.S.

5️⃣ Crypto mining moves

Relatively new to the mining scene since last summer, Swan Bitcoin is going full steam ahead. With $100 million in investments, they've got plans to up their mining muscle 44% by March and are still looking for more funding to continue expansion. Until now, the firm has mined more than 750 bitcoin across its seven mining sites and has three more in the works.

Meanwhile, OKX is shuttering its Mining Pool services. As of Friday, new-user registrations ceased with lights out for all mining pool-related services slated for Feb 26. OKX assures everyone they're still committed to delivering top-notch services like their exchange and wallet.

Bitcoin mining rig manufacturer Canaan Inc. secured $50 million in its second preferred shares financing. The funds will boost R&D, expand production, and support corporate initiatives. Especially pre-Halving, Canaan is focused on advancing its position in the mining sector.